Value investing is a way to invest that involves buying stocks that seem to be selling for less than their book value. Value investors look for stocks that they think the market is undervaluing.

They think that the market overreacts to both good and bad news, which causes stock prices to move in ways that don’t match the long-term fundamentals of a company. The overreaction gives people a chance to make money by buying stocks at lower prices, or “on sale.”

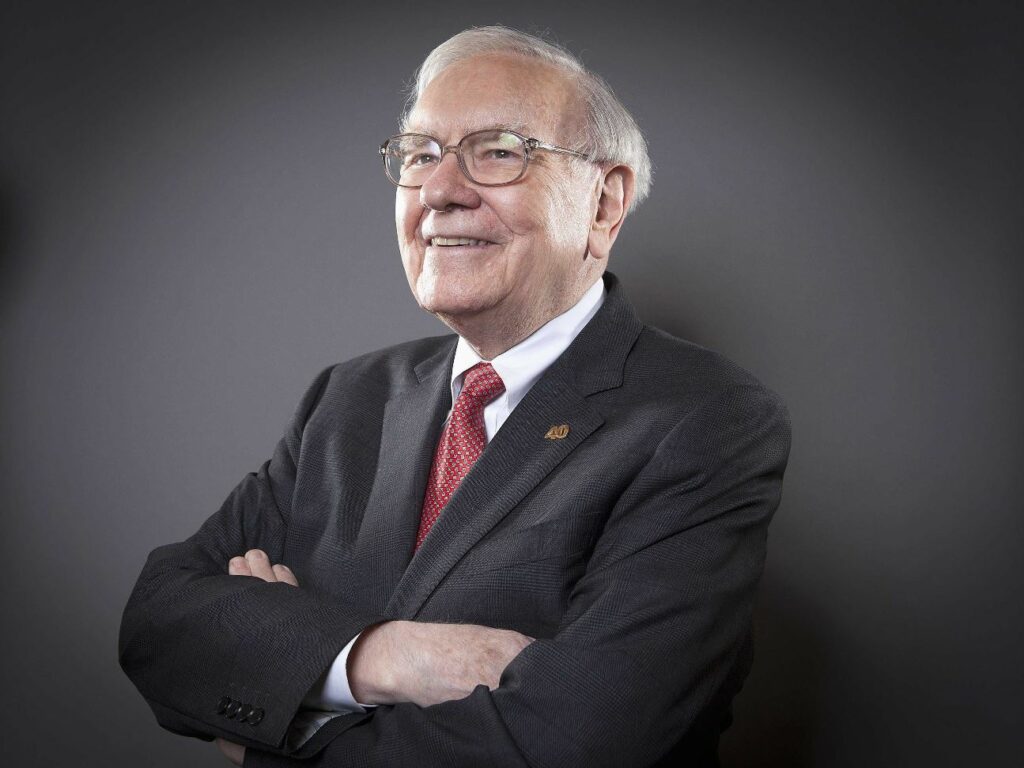

Warren Buffett is probably the best-known value investor today, but there are many others, like Benjamin Graham (Buffett’s professor and mentor), David Dodd, Charlie Munger, Christopher Browne (another Graham student), and billionaire hedge-fund manager Seth Klarman.

How does value investing work?

The idea behind value investing is that an investor who buys stock in a company owns a piece of that company. Even though this may seem like a no-brainer, a lot of investors just “play the market” and don’t care about the fundamentals of the companies they own.

As a business owner, the investor should look at a company’s financial statements to figure out what it is really worth. Fundamental analysis is the name for this kind of evaluation.

Rarely is intrinsic value contained in a single number. Rather, the intrinsic value of a complex business is often a range because it is based on so many assumptions. An investor shouldn’t worry about this lack of detail.

Mr. Buffett once said, “It is better to be approximately right than precisely wrong.” Value investors will think about buying a company if its price is at or below what they think it is worth.

Intrinsic value: how to calculate it?

To figure out what a company is really worth, you have to find out the present value of its future cash flows. This, in turn, requires estimating future cash flows and the interest rate to use to figure out the present value of those cash flows. With these assumptions in mind, it’s easy to see why intrinsic value is often a range and not a single number.

Buffett said that judging the relative attractiveness of investments and businesses by their intrinsic value is “the only logical way to do it.”

Some people use a number of metrics to figure out if a company is selling for less than it is worth. Even though none of these should be taken at face value, they can be a good place to start.

With the price-to-book ratio

The P/B ratio compares the price of a company’s stock to its book value per share. The net worth of a company (assets minus liabilities) is divided by the number of outstanding shares to get the book value per share. When investors figure out the PB ratio, they sometimes leave out some intangible assets, like goodwill.

In theory, a value below 1.0 means that the price of a company’s stock is less than what the company is worth. Some banks are worth less than their book value, while some growth companies are worth many times what they are worth.

But there is no one P/B ratio that defines value investments versus growth investments, because these numbers change as the business cycle goes on. The P/B Ratio goes up when the price of a stock goes up, and it goes down when the price of a stock goes down.

With the price-to-earnings ratio

The P/E ratio compares the price of a company’s stock to how much money it makes each year. For example, a P/E ratio of 8 means that it will take 8 years for the company’s current earnings to equal the price of one share.

The company is more likely to be a value stock if its P/E ratio is low. Even though there is no set level that automatically makes a stock a value investment, the P/E ratio should be lower than the average P/E ratio of the market as a whole.

As with the P/B ratio, keep in mind that a lower P/E ratio doesn’t mean that a company is a good investment. These metrics are a good place to start looking into things.

Is value investing the right strategy for you?

You’re probably a value investor at heart if your main goal when investing is to minimize the chance of permanent losses while increasing your chances of making money.

People who like to follow the hottest companies on the market, on the other hand, often find value investing to be downright boring because growth opportunities for value companies are usually weak at best.

Those who invest in value also need to be strong. The value-finding process gets rid of a lot more stocks than it finds, and investing this way during a bull market can be very frustrating.

During a bull market, the prices of many stocks you didn’t put on your buy list because you thought they were too expensive will keep going up. But when the bull market ends, value stocks can make it much easier to ride out a downturn because they have a higher margin of safety.