The global management firm McKinsey has offered the asset owners a chance to glance through the freshly published report on asset management. Asset owners and asset managers have both revised their presumptions about pricing risk throughout the investment sector as the persistent—and, some would argue, secular—nature of these adjustments has become apparent. All major asset classes have essentially struck the reset button.

So, what is the new standard? For the first half of this year, equities declined, with the S&P500 down more than 20% for its worst half-year performance in over 50 years, and fixed income declined by 10% for its worst half-year performance in over 100 years. In response to inflationary pressures, fixed income, once a dependable buffer against market downturns, had a 10% decline in the same period, according to some estimates the worst half-year performance for bonds in more than 200 years.

The high-flying technology sector and emerging asset classes experienced the greatest reversals, with the valuations of some well-known tech unicorns subject to drastic down rounds and cryptocurrency valuations more than halving as investors chose to “get real” with tangible cash flows and hard assets. Despite the recent recovery in asset values over the early summer months, there is still a great deal of uncertainty.

Asset owners and managers reset their investment strategies

2022 marks the turning point for the world markets. Following a decade of comparatively calm—including two years of supernormal returns after the pandemic’s first shock—the global financial crisis, a new reality of supply-side disruptions, geopolitical tensions, and rising inflationary pressures emerged. These elements have prompted a fundamental resetting of macroeconomic policy and the disappearance of the accustomed backdrop of quickly globalizing trade and capital flows, lower interest rates for longer, rising central-bank balance sheets, and accommodating fiscal policy.

As a result, both asset owners and managers are resetting their investment strategies for the new environment of 2022. The North American asset management sector feels the effects of three key changes in the market environment, according to McKinsey’s annual asset management research, “The Great Reset: North American Asset Management in 2022,” which has been published recently.

Three key changes for asset owners

The asset management sector began 2022 in an uncharacteristically good position, with excellent inflows and performance from 2021. Assets under management (AUM) for the entire industry reached a high of $126 trillion, or 28 percent of the world’s financial assets, up from 23 percent a decade earlier. The region with the largest growth in revenues and assets under management, with sales hitting a record $526 billion, is still North America, which tops the geographical rankings.

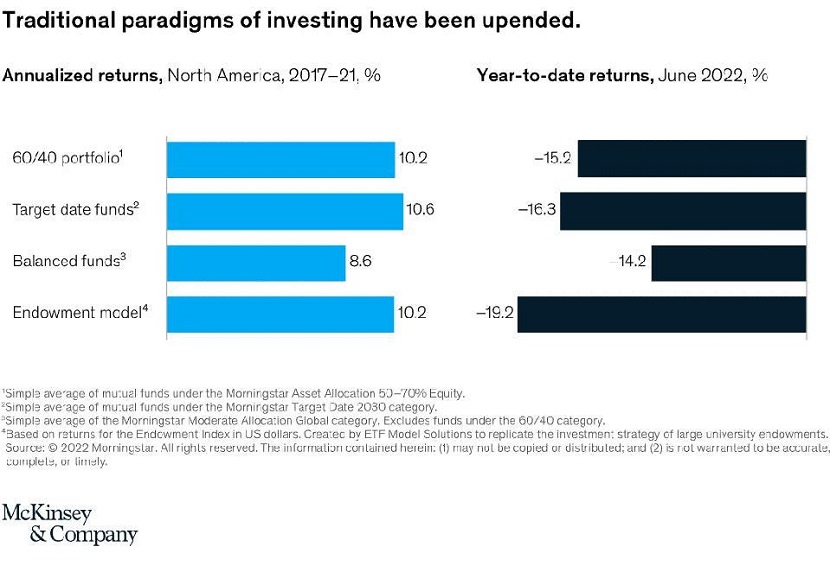

Due to the disruption of conventional investing paradigms, institutional and retail investors are under extreme pressure (see chart below).

Some of the defining foundational developments of the asset management industry over the past ten years, including as the commoditization of bulk beta and the expansion of risk-on and leverage-oriented business models, have been called into question by the investing climate.

The status-quo remains in near future

The report also discusses how enduring industry trends might change, but McKinsey anticipates that many things will remain mostly same in the foreseeable future.

First of all, management that is active is nevertheless under pressure. However, at the halfway point of 2021, 55% of active equities managers were still underperforming their benchmarks, around the same as for 2021. This is contrary to expectations that recent market moves would serve as a catalyst for a potential active comeback.

Furthermore, exchange-traded funds are going to rule, setting new milestones in 2021 with $900 billion in cumulative flows. Active fund withdrawals followed by inflows into related ETFs, such as for tax loss harvesting, are a noteworthy pattern to keep an eye on. Moreover, private market investing is still in demand, with yield-oriented and inflation-protected strategies drawing particular attention in 2022.

Although guidelines are ambiguous in the short term, there is an increasing emphasis on sustainability. Clearer standards and the creation of higher-quality, more reliable data will be beneficial. Additionally, the preference for comprehensive portfolio solutions over singular assets is becoming more and more significant.

Building “all-weather” asset management systems

What effects will the Great Reset have on the organization, efficiency, and future of the asset management sector in North America? McKinsey’s comprehensive analysis begins by quickly assessing the industry’s starting point—its performance and health following two incredibly exceptional years during the pandemic era—in order to respond to the issue. The experience of those years has produced both potential and vulnerability, according to the McKinsey assessment. The research then examines how the sector has been impacted by the secular shifts of 2022 to date, as well as what effects those shifts are likely to have on a number of well-known industry trends that have been developing over the past ten years.

Although the markets saw a respite in the early summer, the macroeconomic volatility that has persisted puts new expectations on asset owners and managers for increased resilience and rapid innovation. Building “all-weather” asset management systems that are adaptable, stable, and scalable is the best strategy, according to McKinsey, for asset managers to manage today’s uncertainties.