It may not seem like high-net-worth individuals (HNWIs) have much to worry about in an environment of expanding income disparity, where the wealthy are accumulating money at new levels while a record number of average citizens live paycheck to paycheck. An individual with a net worth of $30 million or more is referred to as a ultra-high-net-worth individual (UHNWI). The ultra-wealthy deal with their own distinct brand of financial issues, even though it takes a special kind of financial irresponsibility for someone with that kind of wealth to develop the kinds of money problems that afflict the rest of society, such as bankruptcy, foreclosure, or wage garnishment.

Many contend that HNWIs’ financial issues are ones that the majority of people in the world would adore having—similar to being excessively attractive, intelligent or having an excessive number of Saturday night invitations to chose from. These issues include ever-evolving tax rules, estate planning, sustaining their lifestyles after retirement, and protecting the principal in their financial accounts. A HNWI worth $50 million is frequently petrified to death of falling below the level of a basic millionaire, despite the fact that this may seem absurd to someone earning the average salary for an average job.

Who can be a high-net-worth individual?

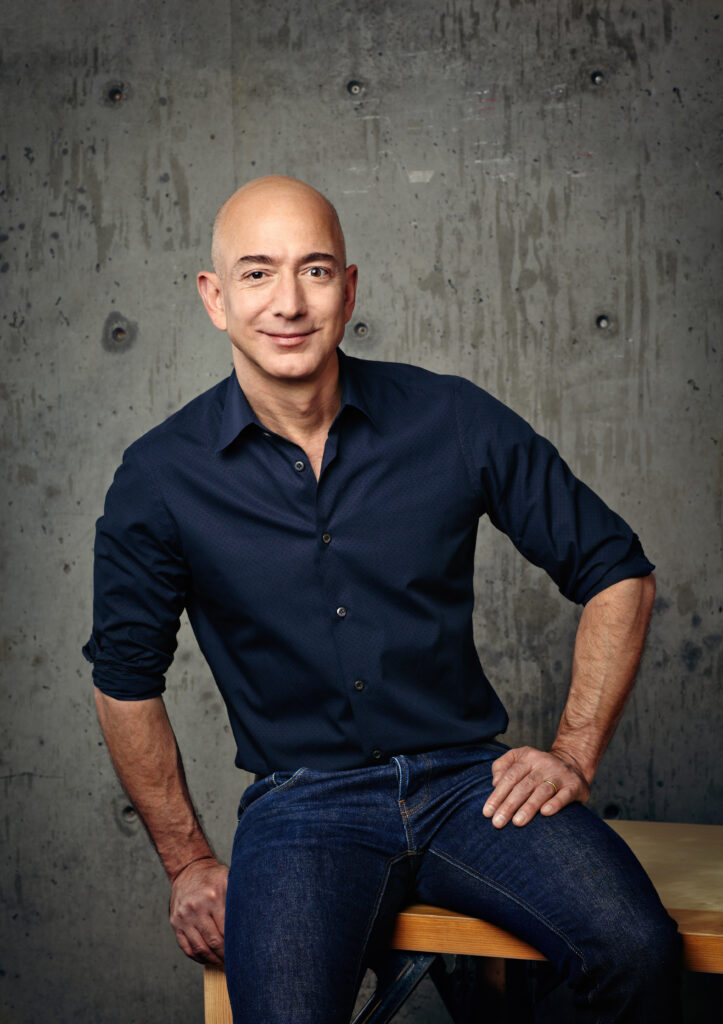

A high-net-worth individual (HNWI), as stated above, is somebody with a net worth of over $30 million, including their primary property. People who fit into this group typically hold a sizable amount of the world’s wealth, making them the richest people in the world. Around 513,244 HNWIs lived in the world in 2019, with 240,575 of them residing in the US alone. Among the wealthiest individuals in the world who fit this description include Jeff Bezos, the creator of Amazon, Mark Zuckerberg of Meta (previously Facebook), Warren Buffett, Bill Gates, and the Walton family, who are the Walmart fortune’s heirs.

Revisions to tax codes for high-net-worth individuals

The way in which the extremely rich get taxed has been a political hot potato for the entirety of the twenty-first century. Few subjects in recent memory have so clearly and ideologically split lawmakers and the general public. On the one hand, proponents of the supply-side approach channel Ronald Reagan, arguing that keeping taxes low for the wealthy allows them to invest in ways that boost the economy and create jobs for everyone else. The trickle-down economics school of thought encourages tax cuts for the wealthy not only for their own gain, but also because their success trickles down to the rest of society.

Then there is the opposing viewpoint, which contends that the middle class and the working poor bear an unfair portion of the tax burden and that HNWIs take advantage of tax breaks and ingenious accounting techniques to pay far less than their fair amount. Long-term capital gains, which are a common way for wealthy people to accumulate their money, are explicitly mentioned by proponents of greater taxes on the wealthy. Long-term capital gains are subject to income-related taxes, with the top earners paying 20%. The largest revision to the tax code in roughly 30 years was made by the Tax Cuts and Jobs Act under former president Donald Trump administration. That rate was reduced by the new code from 39.6% to 37%. These modifications are only temporary and are anticipated to end around 2025.

High-net-worth individual estate planning

High-net-worth individuals are concerned about keeping their wealth so they can maintain their current standard of living. However, the majority of them also desire to leave their wealth to their heirs after their passing. They desire that as little of this money as possible be taken by the government before it is passed on to future generations.

Only the very rich are subject to the estate tax, and the top 10% of earners are responsible for paying more than 90% of the tax. Roughly 40% of estate taxes are paid by 0.1% of the richest people in the country. For the 2019 tax year, the estate tax exemption has been increased by $11.4 million as a result of the Tax Cuts and Jobs Act. In 2020 and 2021, this amount was $11.7 million and $11.58 million, respectively. Anything above and beyond that amount is taxed at a rate of 40%.

Although the exemption has grown over time, the top estate tax rate has actually decreased. Anything beyond the $600,000 exemption in 1997 was subject to taxes of up to 55%. This indicates that the more a high-net-worth individual stands to lose upon leaving of their estate, the more the estate is worth—at least it’s above the exemption. In addition, a lot of states apply their own estate taxes on top of the federal estate tax. Some also charge beneficiaries inheritance taxes.

HNWIs employ a variety of strategies to lessen the impact of the estate tax. In order to avoid the estate tax, these strategies include leaving their estates to surviving spouses, who are then free from paying taxes on them, giving to charities, and creating a variety of trust accounts.

Retirement lifestyle of HNWIs

Investing made HNWIs wealthy, therefore there isn’t really a difference between working and retirement years for them. Age is not an issue for these people; they are inclined to keep doing what has worked for them. However, those who acquired HNWIs through employment, such as CEOs and other well-paid professionals, can experience an income loss when they opt to retire. While having $30 million or more should be sufficient to support any type of retirement lifestyle, some HNWIs manage their money poorly and may eventually need to pull back.

Illiquidity is a problem that occasionally affects HNWIs. Despite having millions of dollars, much or all of it is invested in real estate, land, and other assets that are difficult to convert to cash. When they still have a steady stream of income, other HNWIs do not experience the repercussions of their excessive risk-taking as much. However, when they retire, a significant loss is harder to recover from.

Keeping their money safe

The majority of HNWIs do not keep their money in low-yielding investments like certificates of deposit (CDs), money market accounts, cash value life insurance, and other so-called safe investments. The fact that they use aggressive investment vehicles that constantly outperform the market is one of the reasons they are so affluent. However, in concerns of the market, reward and risk frequently go hand in hand. The high-growth assets that made UHNWIs wealthy are usually the first to experience a sharp decline when a bear market or recession strikes. Due to this, HNWIs who depend on the markets for their income frequently experience ongoing worry due to the possibility of an impending crash.