However, unlike many other human abilities, such as language processing, visual perception, object manipulation, reasoning, planning, and learning, computers are not particularly good at crunching numbers. Deep learning and machine learning are examples of artificial intelligence (AI) that employs computers to execute activities that would typically need human intelligence. This opens new areas of interest and business. Contrary to popular belief, investing in AI stocks is less common. But, machine learning and AI technology efforts are widely promoted by businesses. Yet, there aren’t many publicly traded pure-play AI equities.

How much popular is investing in AI among businesses?

Businesses generally employ artificial intelligence in two ways. The current operations of many IT companies, including well-known ones like robotics, self-driving cars, and virtual assistants, have the reinforcement of artificial intelligence (AI). For Gmail users, Google, an Alphabet company, employs AI to filter out spam. While Netflix utilizes AI to help with content production and suggestions, Amazon employs AI to recommend products to customers.

Some businesses make a direct profit from AI by providing the necessary tools, software, services, or expertise. These stocks, along with those mentioned and discussed below, are actual artificial intelligence equities.

Investing in AI: best stocks to purchase in 2023

Nvidia

The AI boom has benefited Nvidia, a market-leading producer of graphics chips, by making its graphics cards the de facto standard in data centers all over the world. In fiscal 2022, Nvidia’s data center business, which now accounts for a continuously growing portion of the company’s overall revenue, probably outperformed gaming in terms of revenue. But one of the factors fueling the company’s expansion is AI.

Autonomous vehicles are another topic of interest. Nvidia creates technology and software solutions that can support both driver-assistance and fully autonomous driving. A self-driving car must identify objects like pedestrians and other vehicles in real time, gather massive amounts of data from several sensors and cameras, and make challenging decisions. They demand a huge amount of computing power, and Nvidia’s technology gives just that. Although more specialized CPUs made for AI may eventually displace Nvidia’s graphics cards, the business is now in an advantageous position.

IBM

This established IT company offers integrated hardware, software, and services for big commercial clients. With its mainframe computer systems, it continues to rule several industries, and it routinely accepts multi-year technology contracts, each with a value of hundreds of millions of dollars.

IBM’s AI strategy is to employ the technology in ways that advance knowledge, increase output, or reduce costs. The healthcare industry is utilizing IBM’s AI technology to create individualized care plans, speed the introduction of new treatments, and raise the bar of care. IBM is utilizing artificial intelligence to assist clients with the challenging work of financial regulatory compliance in the financial services sector through the company’s 2016 acquisition of Promontory Financial Group.

Despite the fragmented AI business, IBM is at the forefront of the sector. IDC, a market analysis company, named IBM as the industry leader in AI software platforms in 2020, with a 13.7% market share, up 46% from the year before. IBM is a huge organization that is evolving, and AI is by no means the only area in which it might do so. However, IBM is a wise pick if your intention is investing in AI business that is well-positioned to gain from.

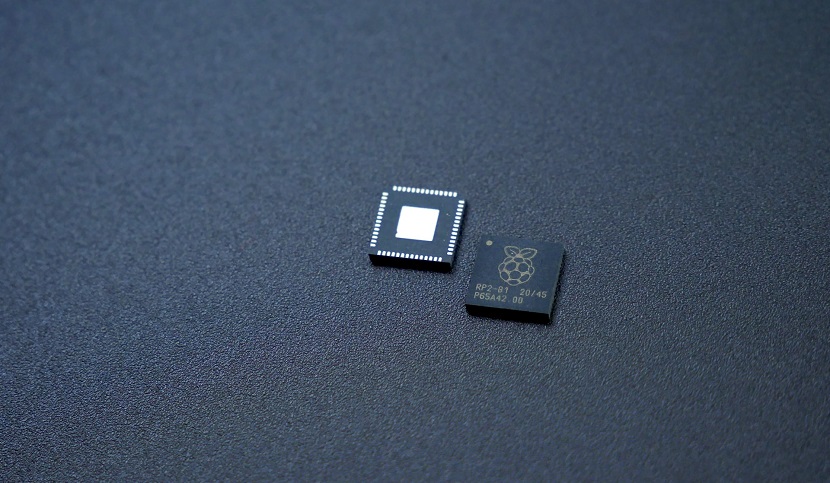

Micron Technology

Micron Technology manufactures NAND flash memory and dynamic random-access memory (DRAM). Both of them are parts of solid-state storage drives. The majority of the products that the company produces are commodities. Thus, pricing is determined by supply and demand. The development of mobile networks, the rollout of 5G, and cloud computing all contributed to the high demand for memory chips in 2021. Prices for Micron’s DRAM and NAND chips have increased as a result of a semiconductor shortage and a rebound in the automobile industry. In the current environment, profits are rising quickly.

Future memory chip demand will increase, with the AI industry reaping the greatest rewards. Autonomous vehicles are a nice example. According to estimates from Micron, all the sensors and cameras generate a lot of data—roughly 1 GB each second. A lot of memory is vital for both data centers and smartphones that might run AI programs. Because of the nature of its industry, Micron’s stock price will undoubtedly remain unstable. Long-term need for memory chips is fueled by AI, but in the short term, supply and demand rules supreme.

Amazon

The company that employs AI the most may be Amazon. Jeff Bezos, the company’s founder and executive chairman, is a supporter of artificial intelligence and machine learning. Even though Amazon kicked off as an online store, technology has always been the foundation of the company.

Amazon uses artificial intelligence in a variety of products today, including Alexa, its market-leading voice-activated technology, Amazon Go cashierless grocery stores, and Amazon Web Services Sagemaker, a cloud infrastructure tool that provides data scientists and developers with high-quality machine learning models.

Since algorithms power its world-class recommendation engines for e-commerce, streaming video, and music, Amazon’s e-commerce operation is likewise based on AI. Amazon also employs AI to decide how to rank products.

Even Amazon’s logistics division gains from the AI prowess of the company, which aids in scheduling, rerouting, and other methods to increase delivery accuracy and effectiveness. Another use of AI for the internet behemoth would be drone delivery, which the business has long tried to adopt.

The effects of AI on Amazon’s business are hard to measure, but it’s obvious that they play a significant role in the company’s competitive edge. Amazon has always been at the forefront of cutting-edge innovations, including voice-activated technology, cloud computing, video streaming, and e-commerce. A significant portion of the infrastructure that enables the organization to enter new markets rapidly and successfully is provided by AI.

C3.ai

As implied by the “ai” in the company’s name and ticker, C3.ai may be the closest approach to a pure-play AI stock currently traded on the stock market. While C3.ai is a company that just deals with AI, the businesses on the aforementioned list are diverse IT behemoths or chip makers with a few AI-related enterprises.

A SaaS firm called C3.ai develops software that enables businesses to use powerful AI applications. With the company’s products, clients may create software faster, for less money, and with fewer risks. The pioneer in its field, C3.ai claims it is not aware of any other end-to-end enterprise AI development platforms that directly compete with them. Despite the fact that the AI SaaS industry is developing and might draw competition from major cloud infrastructure providers like Amazon or Microsoft, the company may ultimately benefit greatly from its unique location.

Investing in AI: a growing industry

It is anticipated that overall spending on AI systems will increase from $37.5 billion in 2019 to $97.9 billion in 2023. The AI industry is expected to expand at an annualized rate of 28.4% over the five-year period ending in 2023. Numerous businesses can benefit from investing in AI because the market is currently sizable and is expanding swiftly. These top AI stocks are all worth taking into account, even if choosing companies in a growth industry is very unpredictable.