Value stock investing is a method that involves choosing stocks based on the underlying company’ perceived value. Value investors often use fundamental indicators like price-to-book (P/B ratio), price-to-earnings (P/E ratio), price-to-sales (P/S ratio), and debt-to-equity (D/E) ratio to calculate the perceived value per share. They look for equities that are undervalued and purchase them in the hopes that the market will eventually value them fairly. Value investors frequently act in a contrarian manner, purchasing stocks when the market is declining and selling them when it is rising.

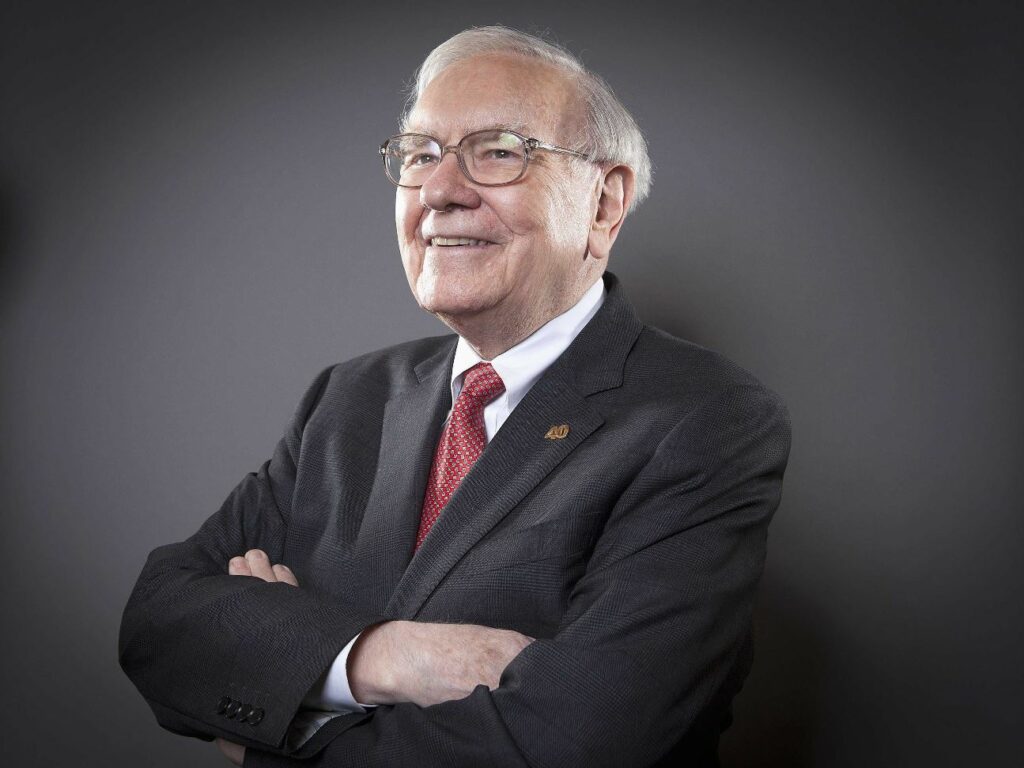

Value investors sometimes overlook short-term market trends in favor of concentrating on purchasing stocks of reputable businesses with the potential to produce large profits over the long run. Warren Buffett, the CEO of Berkshire Hathaway, famous investor Benjamin Graham, author of “The Intelligent Investor,” and billionaire hedge fund manager Seth Klarman are all well-known value investors.

How do value stocks work?

A value stock is a stock that an investor or analyst considers to be of lower value in light of the underlying company’s business characteristics. The same way that bargain buyers look for bargains at the mall or on Amazon while a sales event is taking place, value investors search for low prices on value stocks.

Value stocks are seen as relatively low-risk investments because they are frequently inexpensive. A low P/E ratio or P/S ratio does not always indicate that a stock represents an appealing opportunity for value investors, which is unfortunate because many cheap stocks are cheap for excellent reasons.

A company may initially appear to be worth of a value stock investing even when it has slowing or even negative revenue growth, contracting margins, large levels of debt, or it operates in a market that is experiencing a secular decline. Value traps are stocks that are undervalued for good reason because they occasionally lead value investors to make poor investments.

Value stock investing is frequently regarded as a long-term investment approach. Even if a stock is now undervalued, this is not guarantee that the market will raise its price to a level that is more appropriate within the next several months or even years.

Value stock investing: how to make the right choice?

The goal of value investing is to identify businesses that are undervalued relative to their inherent worth with the expectation that they would outperform the stock market as a whole in the long run. Finding inexpensive stocks is more said than done, though. Having said that, the following are the top three metrics to have in your toolset while you look for a deal:

– P/E ratio: This stock value gauge is the most well-known, and for good reason. When comparing the valuations of businesses in the same sector, the price-to-earnings ratio, or P/E ratio, can be a very helpful measure. Simply divide the stock price by the company’s yearly earnings to determine it.

– PEG ratio: Comparable to the P/E ratio, this metric levels the playing field across businesses that might be expanding at slightly different rates (thus, PEG, or price-to-earnings-to-growth, ratio). You may compare various firms more fairly by dividing the P/E ratio of a company by its annualized earnings growth rate.

– Price-to-book ratio (P/B): Consider the book value as the amount that would supposedly remain after a company ceased operations and sold all of its assets. Many value investors specifically search for opportunities to buy stocks trading for less than their book value in order to uncover undervalued possibilities. This can be done by calculating a company’s share price as a multiple of its book value.

Beware of value stock investing traps

Avoiding value stock investing traps, which look to be attractively valued but are cheap for a reason, is one of the most important aspects of value investing. Value traps frequently offer alluring basic indicators, including low price-to-book or price-to-earnings ratios. Yet, value traps frequently have structurally troubled businesses, which can eventually cause these value measurements to degrade. Value traps might, for instance, be experiencing secular sales reductions in a contracting business or losing market share to rivals.

Investors should have a thorough understanding of a company’s operations to avoid value traps. This means that before making a sizeable long-term investment, you should undertake thorough due research until you are confident with the overall picture of a company’s prognosis.

The top 3 companies for value stock investing

Publicly traded companies that trade at relatively low valuations in relation to their earnings and long-term growth prospects are known as value stocks. Let’s look at three great value stocks:

1. Berkshire Hathaway

Since CEO Warren Buffett assumed control of Berkshire Hathaway in 1964, the company has expanded into a conglomerate with more than 60 completely owned businesses and a sizable stock portfolio comprising more than four dozen different positions. In spite of operating under the same business strategy that has allowed the company to nearly double the annualized return of the S&P 500 index for more than 55 years, Berkshire has continuously expanded its book value and earnings power over time.

2. Procter & Gamble

Their product line includes dozens of other brands in addition to Gillette, Tide, Downy, Crest, Febreze, and Bounty. Procter & Gamble, one of the most dependable dividend stocks on the market, has been able to steadily increase its revenue over time because to the popularity of its several brands. Because demand for P&G’s products remains consistent over the course of stock market cycles, it is a prime example of a stock that is recession-resistant. Although while management anticipates a slowdown in sales growth in 2023, the company’s size, stability, and variety of products make it a strong option in trying times.

3. Target

The cult-like following of big-box retailer Target keeps expanding, helped in part by the success of its house brands. The company’s online sales have increased, similar to those of other retailers, since the pandemic’s start. But, Target’s distinct digital business strategy, in which stores fulfill 95% of all purchases, including online orders, provides it an advantage over rivals and enables it to maximize speed while minimizing costs.