Blue chip stocks are the shares of renowned, superior businesses that are pioneers in their fields. Customers and stockholders value these businesses because they have withstood the test of time. Blue chip companies have strong business models and a proven track record of providing investors with positive returns. Blue chip stocks are among the most well-liked by conservative investors because of these returns, which frequently include consistent and rising dividend payments. But, even riskier investors should think about investing in blue chip firms to increase the diversification of their portfolios and offer some safety during volatile market conditions.

A blue chip stock often has a market valuation of billions, is frequently a household name, and is either the market leader or among the top three corporations in its industry.

What are blue chip stocks?

The stocks of blue chip businesses have a track record of strong performance in both good and poor economic conditions. The following characteristics are typically shared by stocks that are categorized as blue chip stocks:

– Large cap companies, or stocks with a market value of $10 billion or more, are frequently blue chip stocks;

– Blue chip companies have a dependable history of consistent growth and promising futures. They might not be as eye-catching as rapidly expanding tech stocks, but that’s because they’ve already made their mark;

-Major market indices like the S&P 500, S&P 100, Dow Jones Industrial Average, and/or Nasdaq 100 include blue-chip stocks as constituents.

– Blue chip stocks don’t always pay dividends, but many do. Businesses that issue dividends are frequently mature, thus they might not need to reinvest as much money in their expansion.

Why should you buy blue chip stocks?

Your portfolio shouldn’t be dominated by any one kind of stocks. Even if you invest in businesses that are generally regarded as being rock-solid, diversification is still important in the investment process. Spreading your money across several company kinds is necessary for diversification. This entails taking into account businesses with small, midsize, and big market capitalizations, as well as firms from different sectors and regions.

Nonetheless, because of their dependability, investors prefer blue chip stocks, particularly older or more risk-averse investors. They are not immune to market downturns, but they have a track record of surviving them and coming out on the other side. Investors value blue chip businesses’ normal dividend payments as well. If you’re investing for income, as many investors do in retirement, dividends are particularly alluring. Blue chip stocks often offer consistent, rising dividends.

Best blue chip companies on the market

The names of several major blue chip stocks will be familiar to you even if you have never invested in the stock market. For billions of people worldwide, these large-cap corporations supply goods and services that are essential to daily life.

1. Apple

One of the biggest businesses in the world, Apple, has led technological breakthroughs throughout its existence. With its Macintosh computers in the 1980s, iPods in the early 2000s, and today’s omnipresent iPhones, iPads, and Apple Watches, the corporation set the standard for innovation. In a world where people swarm to the newest technological trends, Apple’s products inspire significant commitment from its clientele. Via its services, which include its streaming television, iTunes, and App Store operations, Apple also generates recurring revenue. Even so, it is still the biggest publicly traded corporation today, and the company is expanding.

2. Berkshire Hathaway

Via its subsidiaries GEICO and Gen Re, Berkshire Hathaway, a significant player in the insurance sector, offers a variety of commercial and personal insurance products. However, Berkshire also owns numerous companies, including the utility firm Berkshire Hathaway Energy, the food brand Dairy Queen, and the world’s largest railroad, BNSF. The organization has a reputation for safety and security as well as dependable performance due to its wide range of activities.

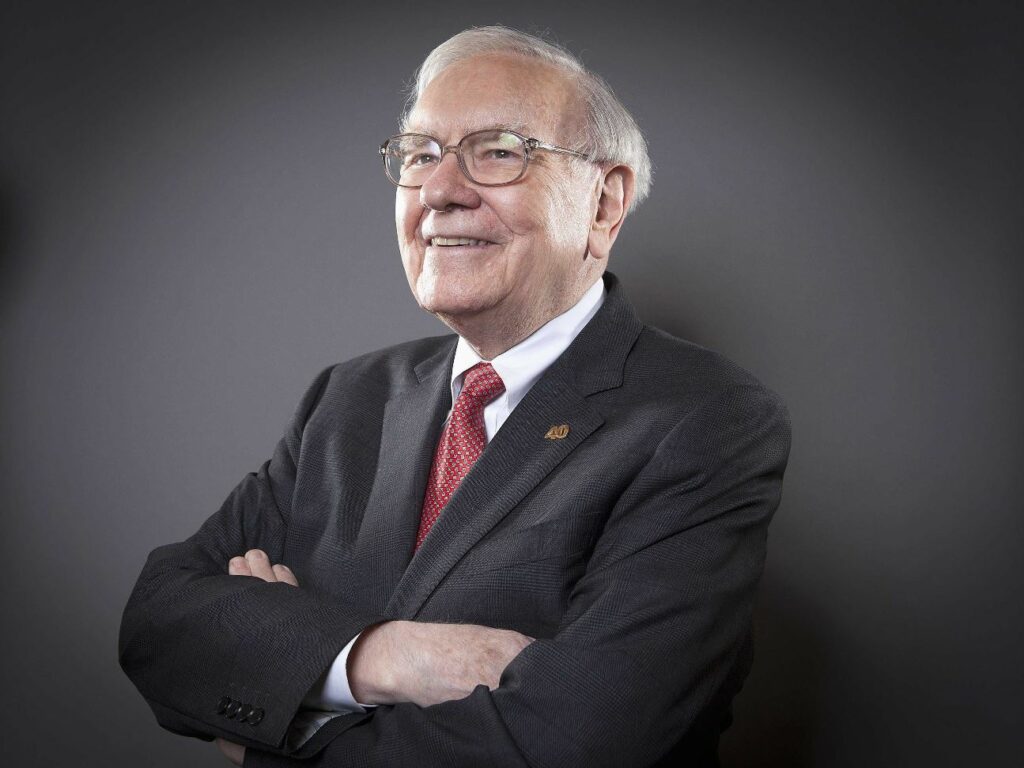

The only blue chip firm on this list that doesn’t pay a dividend is Berkshire Hathaway, which is significant to notice. CEO Warren Buffett likes to invest the company’s cash rather than distribute dividends and has one of the most spectacular records of outperforming the market returns in history.

3. Coca-Cola

As its namesake soft drink developed a global empire, Coca-Cola has been a leader in the beverage sector for more than a century. But, it has also evolved with the times and today offers a far wider range of goods, including juices, sports drinks, and bottled water designed for more health-conscious consumers. Coca-Cola distinguishes out for boosting its dividend in particular. Since the early 1960s, it has increased its annual dividend payment in a continuous pattern, earning it a spot among the top 10 dividend companies on the market.

4. Johnson & Johnson

The well-known consumer goods manufactured by Johnson & Johnson include baby shampoo, Band-Aids, and Tylenol painkillers. But, J&J is a true healthcare behemoth that manufactures a vast range of medical gadgets to aid physicians and other healthcare workers in performing life-saving surgeries. Johnson & Johnson also manufactures medicines and conducts a sizable pharmaceutical industry. By November 2023, J&J will be divided into two firms, and this is something to pay attention to. Consumer health products, which are thought to be the weaker area of J&J’s business, will be the focus of one company. Its well-known pharmaceuticals and medical device industry will be in the other.

5. American Express

American Express is another well-known blue chip company to take into account. It functions as both a payments network and a credit card company. Credit card fees and transaction processing fees are its key sources of income. With more users and increased transaction volume, the company is in a good position to grow both income streams. Although being more than 170 years old, it seems to be still relevant today.

The management of American Express is confident that it can increase profits at a double-digit rate going forward and it also intends to distribute around a quarter of its income as dividends to shareholders. Future raises should result from continuing earnings growth.