It has long been a practice to spend money wisely by making an investment to put it to good use. Those who want to make more money typically seek to the stock market, real estate, and other attractive business prospects. These businesses all have the capacity to generate turnover, which is what unites them. The investment community is constantly searching for promising prospects because people want to see their money grow. Because any investment carries a risk, history has shown that even the quickest investments can go bad. Because of this, more and more investors are expanding their search for investment options and expanding their horizons. And, one of those is diamond investing.

A sizable segment is searching for the best alternative investments. It is nothing new to invest in diamonds, especially color diamonds, but recently, it has been more commonplace to do so seriously. Having said that, investing in color diamonds is not suitable for everyone, and those who do so must proceed carefully. Here are some pointers to assist you maximize your investment in diamonds and get started on the road to diamond investing.

Why diamond investing

With everything it includes, diamond investing should be included in your list of alternative investments. So, they ought to make up a little fraction of your portfolio. The concept is really fairly straightforward. The basis for investing in diamonds is the fact that they are tangible goods. As a result, you may readily purchase them anywhere, including online.

A diamond is an investment that will make you happy not just by its presence but also by its beauty, which you may appreciate every day, for instance as a piece of jewelry. It’s incredible that something so little can cost millions of dollars. The diamond may be carried around easily or kept in even the smallest safe.

In line with inflation, commodities like real estate, gold, silver, and diamonds are becoming even more expensive. This safeguards them from depreciation and is a feature of practically all physical goods. Thus, there has never been a significant decline in the price of diamonds. These bright stones kept growing throughout the pandemic.

The right steps to diamond investing

Although buying diamonds can seem quite alluring, it is important to keep in mind that this is a complicated process with its own peculiarities. Also, this process has a high potential for risk.

1. Basics of diamond investing

Even if you want to hire a highly skilled professional to help you choose an investment diamond, it will be beneficial if you understand the fundamentals of the diamond industry. You will be better equipped to grasp how diamond prices are set, how to negotiate the market for them, and why some diamonds are more valuable than others. Start with the fundamentals by learning about the 4C, which white diamond shade is deemed the most expensive, and which fancy color diamonds are the rarest.

2. Plan a budget

Do not forget that this belongs in your portfolio. True, compared to stocks, a larger initial investment is necessary, but this is no excuse to exceed your spending limit or the proportion of your portfolio that you had in mind. Thus, be quite clear about how much you are willing to spend on diamonds. Of course, the actual purchase could, on occasion, come in slightly above budget.

3. Have multiple options for diamonds

It can be challenging to predict with certainty when, by how much, and for which stone the price of diamonds will increase in the future. Utilize all of your common sense, and diversify your diamond wagers. Consider Blue or Pink if, for instance, you are dreaming about an Orange diamond. Let your budget be divided among various diamond varieties. Any of these might out to be a wise investment, or perhaps only one will eventually return every penny you invested. The ability to liquidate a piece of your portfolio in the event that you need to deploy some of your investment cash is another fantastic benefit of this.

4. Invest in valuable but unique stones

It takes the greatest flair or industry expertise to flourish in the diamond market, which is a very difficult and delicate topic. The trick is finding the ideal diamond for investment that won’t be too common (there might be little demand for such a stone later), but at the same time, don’t bet on a too rare and unpopular sort of stone (the reason is the same – there will be low demand for it later). While discussing the ideal diamond, consider its color, weight, clarity, and cut. Simply put, a round diamond is easier to resale than a marquis-cut diamond with the same qualities.

5. Request a certificate

This is general knowledge that applies whether buying a diamond, gemstone, or any investment stone. Always demand to see the certificate. First of all, one may unquestionably trust the qualities listed in it. They determine the stone’s pricing; even a small adjustment in any one of these factors can have a big impact on the diamond’s worth. Second, you very certainly intend to sell an investment diamond if you buy one. Most likely, your prospective buyer will also request a certificate. The certificate is the finest evidence of the legitimacy and worth of the diamond you are presenting to them.

Disadvantages of diamond investing

As we have frequently stated, buying diamonds is a dangerous process just like buying any other kind of investment. It is best to anticipate some hazards and obstacles in advance; at the very least, you should be aware of them.

Diamonds are not stocks; patience is a virtue. There is almost no probability that the diamond you purchased will increase 30% in value the following year (not that it happens too often in stocks as well). Think about the diamonds you purchased for the portfolio’s long-term investment section.

Price Transparency

Diamonds lack a stock exchange-traceable price index, in contrast to other goods like gold and silver. Most diamond dealers use the Rapaport price list; however, this is insufficient on its own. Even if you can obtain a copy of the list, it won’t be helpful for a number of reasons because it is just used as a standard. It solely considers the fundamental elements of carat weight, clarity, and color. In the end, supply and demand on the market determine the price. Some gems are purchased by merchants both above and below the price list. A 10% difference is significant. Moreover, there is no current list (or benchmark) for colored diamonds; this list solely applies to white, colorless diamonds.

Doing extensive study is the best method to get over this drawback. Make sure you shop online price comparison sites and buy from a reliable retailer who is known for being honest.

Problems with tradability

Occasionally, purchasing a diamond is simpler than selling one. Keep in mind that when you buy an investment diamond, you will ultimately have to put in a lot of effort. If you’re selling a diamond to a different shop, you’ll need to speak more persuasively than they do to persuade them that the price you’re asking is reasonable. Auction houses are still another choice for the sale of investment diamonds. Yet, they exclusively display very excellent stones and charge a commission.

How to choose the right diamond?

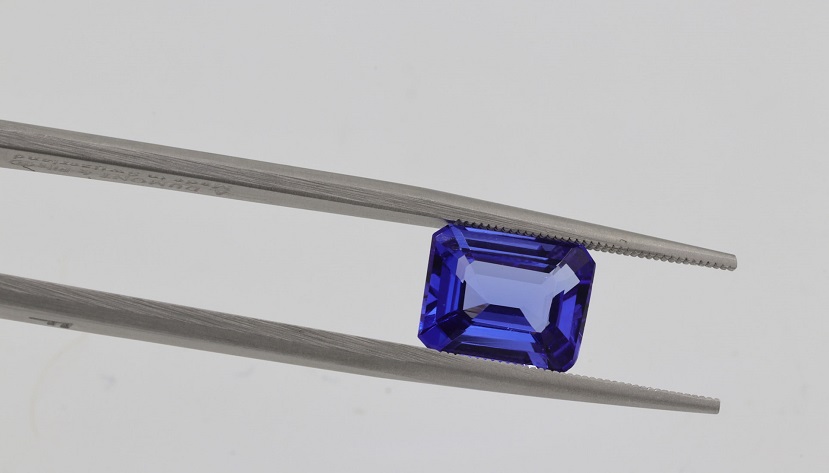

Since there are very few large, flawless, colorless, or fancy colored diamonds in existence, the majority of them are viewed as investments. The renowned 4Cs—color, carat weight, cut, and clarity—also serve to distinguish the greatest investment stones.

Diamonds that are white and colorless are the most preferred investment choice. Its color grade ranges from D to Z, where Z denotes the existence of color and D denotes complete transparency. Stones from D to H are investment stones. A fancy color diamond is much more uncommon. The more expensive they are, the stronger their color intensity. Those with Fancy Deep, Fancy Vivid, and Fancy Intense color grades are the best to choose. Keep in mind that the rarest diamonds are those that are red, blue, and pink.

The value of the diamond increases with its weight (in case it has other characteristics of the highest grade). The inner fire and brightness of a diamond are due to the cut. When searching for investment stones, pay close attention to stones with an excellent rating.